by Emma Hibbard

What comes to mind with the words investing in the environment? More often than not it involves clean solar and wind energy, green building techniques, or electric cars. However, founder Ian Monroe expanded the investment scope in 2015 with investment management company Etho Capital. By including players from every industry and trade, not just those typically associated with climate issues, Etho’s final product is a diversified and fossil fuel-free exchange traded fund called the “Etho Climate Leadership US ETF.” Trading under the “ETHO” ticker on the New York Stock Exchange, the ETF fund consists of nearly 300 companies that are open to public investment.

The idea behind the ETF is straightforward; invest only in companies that are the most environmentally and socially sustainable while divesting from fossil fuels. Indeed, Etho Capital is a certified B Corporation business. Similar to the ‘Fair Trade’ stamp we see on food and goods, a B corporation is verified in social and environmental performance, public transparency, and legal accountability. B corps are using business as a force for good by capitalizing on the power of financial markets to solve social and environmental problems.

To accomplish this goal, the Etho ETF’s portfolio is compiled by identifying climate-efficient companies using a ‘Smart Sustainability Process,’ narrowing the field to environmental leaders in their respective industries. The first filter calculates the climate efficiency of over 6,000 companies, a factor that measures carbon emissions per dollar invested. From those identified as highly climate efficient, Etho eliminates unsustainable companies and industries including those involved in coal, oil, natural gas, tobacco, weapons, gambling, animal cruelty, and prisons. The results are the top ‘Climate Leaders’ that conform to environmental, social and governance sustainability (ESG) standards.

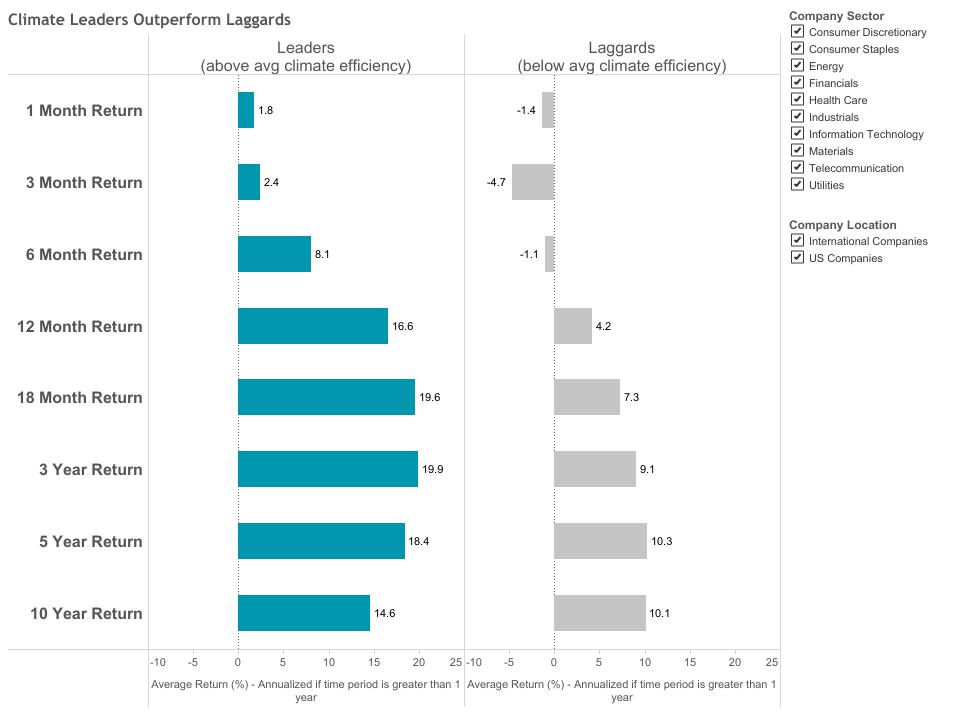

This chart shows 1 month to 10 year average financial returns for Climate Leaders versus Climate Laggards. Climate Leaders had greater returns consistently compared to those with poor climate efficiency. Image: Etho Capital

Beyond purely environmental motivations, what would make smart sustainability a sound investment? Monroe and his colleagues have found that it is not only environmentally beneficial but fiscally profitable! For each industry (including energy, financials, industrials, healthcare, etc), they found that the ‘Climate Leaders’ consistently outperformed ‘Climate Laggards’ (below average climate efficiency) in financial performance. Not only did smart sustainability positively correlate with financial return, but risks on investments were reduced by the removal of unsustainable industries. As an example, in a study conducted by Etho, their index financially outperformed the long-standing S&P 500 index while achieving an 85% reduction in carbon emissions.

Greenhouse gas emissions compared for Etho Climate Leadership Index-US and S&P 500 Index. ETHO outperformed the S&P 500 Index while reducing emissions by 85%. Image: Etho Capital

This innovative method of compiling a stock fund has dispelled popular myths about investing, especially that fossil fuel companies are impossible to avoid for a profitable investment, and this pivots the focus toward investing in a purpose. The accessibility to sustainable investing enables everyday people to push the markets toward clean energy and efficiency by holding big businesses publicly accountable to low carbon standards, creating an economy where lucrative financial returns and a thriving climate go hand in hand.